Returns for C Corporations (Form 1120) are not quite as difficult as returns for other entities. An 1120 return preparation program has to handle depreciation, and things have to balance on Schedules L, M-1 and M-2; otherwise, it just has to permit the easy entry of data.

‘Integrated into the 1041, SAXTAX depreciation handles Form 4562, Form 4797 and calculates depreciation for up to six different depreciation “books”: (1) regular taxes; (2) alternative minimum taxes; (3) ACE; (4) Internal (financial reporting); (5) State; and (6) Other (user definable). The normal cost of our Depreciation Program is $199, but it comes FREE with the purchase of our 1120 Program.

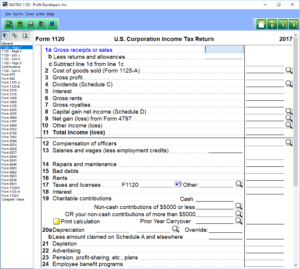

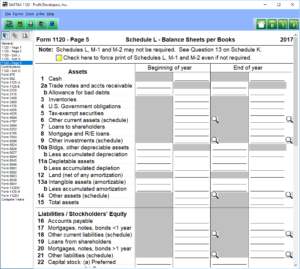

We also have an easy “balancing” screen in the program to assist you with Schedules M-1 and M-2. And with respect to “easy entry of data”, no one does it better. Our easy to use data entry screens are facsimiles of the actual forms (see thumbnail below), and with each entry the entire return is recalculated and totals displayed.

Download a Demo or Order the 1120 Program now.

Click on the Thumbnails below to view sample program screens

1120 Program Features

|

|

1120 Forms

| Form 1120 | Form 3800 | Form 6765 | Form 8846 |

| Form 1120-H | Form 4136 | Form 7004 | Form 8879C |

| Form 1120-W | Form 4255 | Form 8283 | Form 8881 |

| Form 1120-X | Form 4562 | Form 8586 | Form 8882 |

| Form 970 | Form 4626 | Form 8609A | Form 8903 |

| Form 982 | Form 4684 | Form 8824 | Form 8916A |

| Form 1125A | Form 4797 | Form 8826 | Form 8936 |

| Form 1125E | Form 5884 | Form 8827 | Form 8941 |

| Form 2220 | Form 5884A | Form 8844 | Form 8949 |

| Form 3468 | Form 6252 | Form 8845 | Schedule D |